MY ROLE

Product Designer

UX Strategy

Prototype

User Interviews

Usability test

COMPANY

Zello Tech

TEAM

1 Product Manager

1 Tech lead

1 Designer Assistant

1 Dev Front-end

2 Devs Back-end

ABOUT

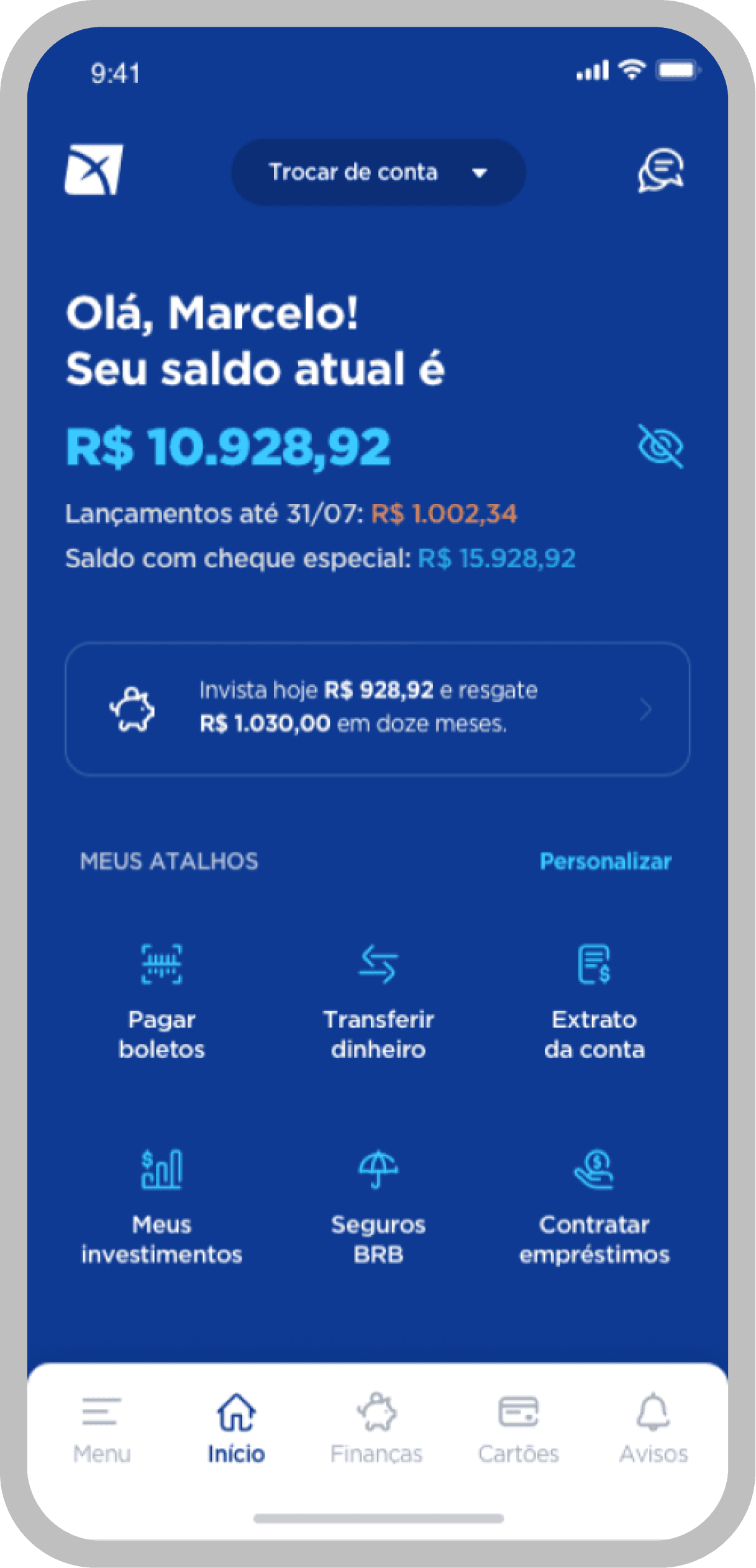

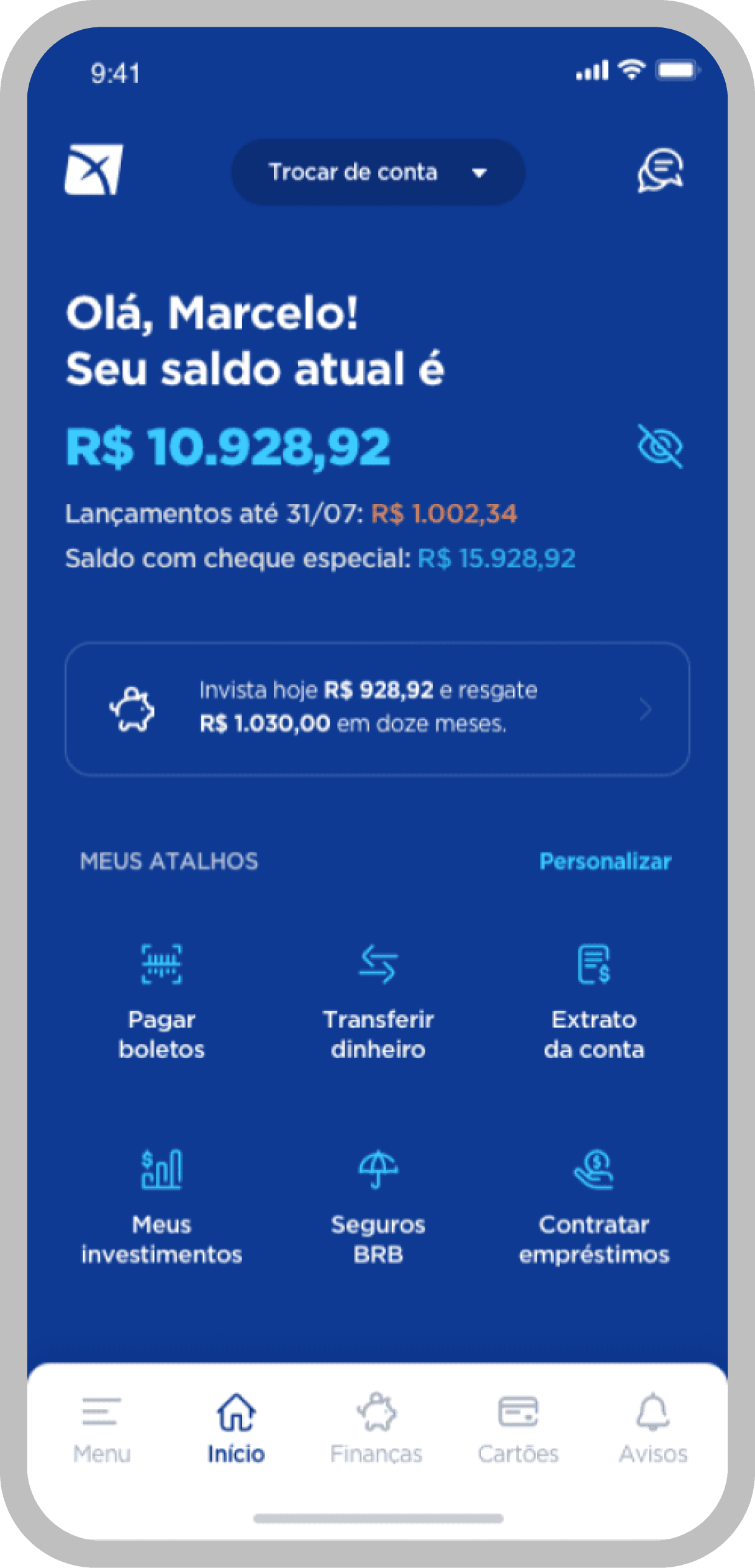

BRB is a bank in Brasília where most account holders are civil servants. In 2019, a new president was appointed and set new goals to take BRB to another level. One of the biggest pains at that moment was the numerous complaints about the mobile app, and that was my challenge.

CHALLENGE

As a more traditional bank, our first challenge was to convince the board to invest in a new application with design processes and methodologies. However, the biggest pains found in the current app were:

• Low adoption by customers;

• High number of support complaints;

• Instability in services;

• Low conversion when hiring new products through the app.

SOLUTION

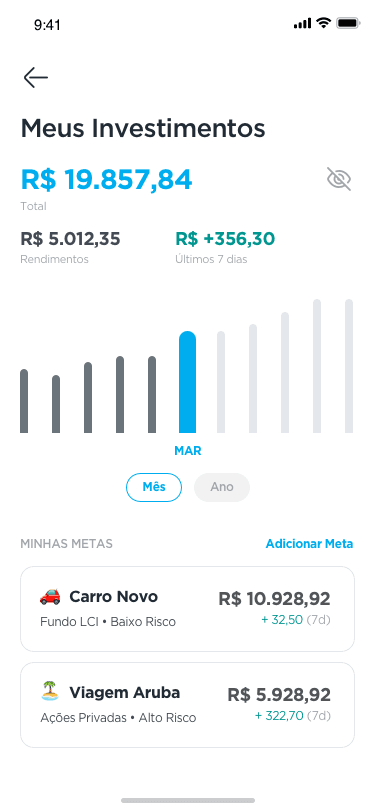

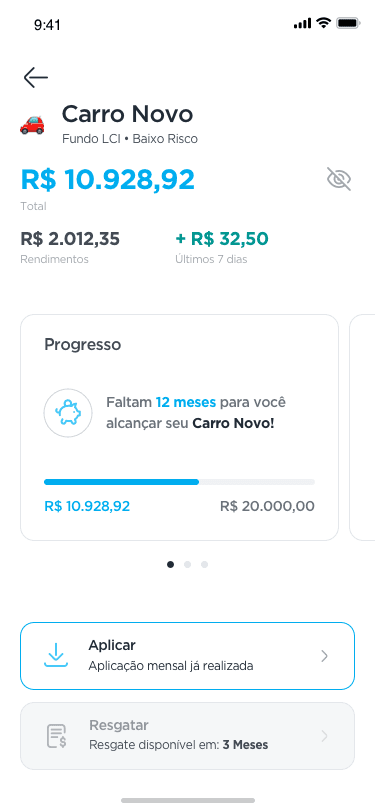

In the discovery phase, we raised some insights that would directly impact the project's KPIs. We decided to create a smart, fast and mostly useful application. So we take initiatives such as:

• Automation of trivial processes;

• Offer products and services at strategic moments of the journey;

• Payment of multiple tickets;

• Reformulation of the service infrastructure;

• Financial education functionality;

• Constantly receiving feedback for the evolution of sprints.

RESULTS

Biggest highlight in the 291.5% increase in the customer base.

Considerable increase in contracting products and services in the app.

LEARNINGS

Initially, we started with a very innovative interface, following many references from the fintech industry, but in interviews with users we noticed that some features were very playful and not so obvious. It was at that moment that we took a step back and started with simpler actions, given that 40% of customers were over 60 years old.